https://www.imoney.my/articles/will-property-flipping-in-malaysia-flop

RPGT Calculation Example

Diana (Malaysian citizen), purchased a house in 2012 for RM415,000. She sold it in 2014 for RM560,000. Let's assume that Diana spent RM30,000 in legal fees, agent fees, administrative fees, and maintenance works;

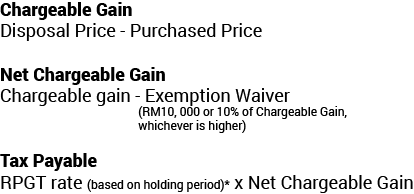

Chargeable gains = RM560,000 – RM415,000 = RM 145,000

Net chargeable gain to be taxed

= (RM145,000 – RM30,000) - 10% individual exemption

= RM115,000 - RM11,500

= RM103,500

Diana sold the property within two years of purchasing it, so the tax imposed on RPGT is 30%.

Tax payable = 30% x RM103,500 = RM31,050.00

No comments:

Post a Comment