Tuesday, 18 November 2014

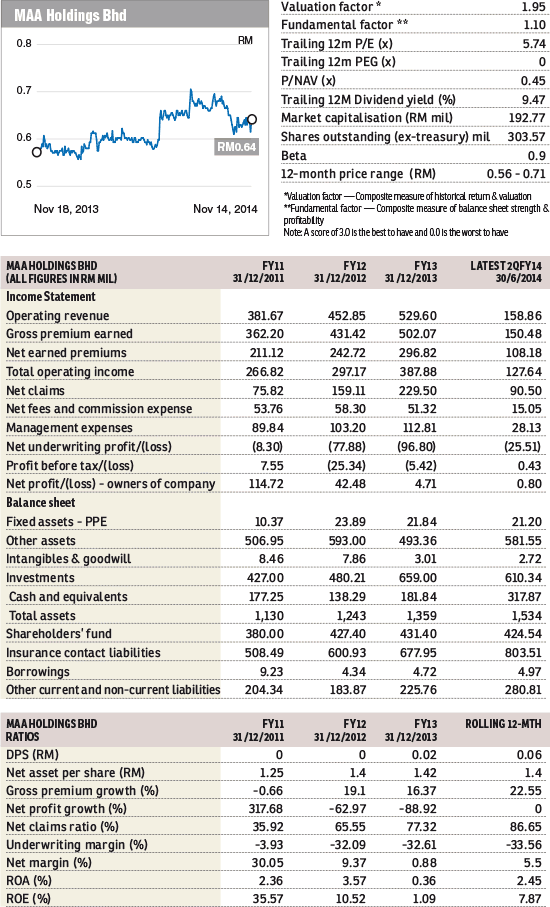

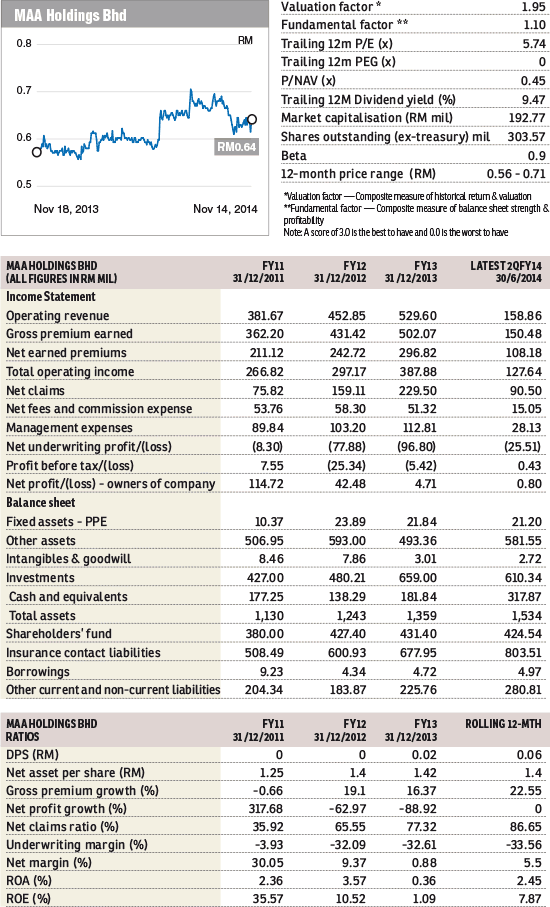

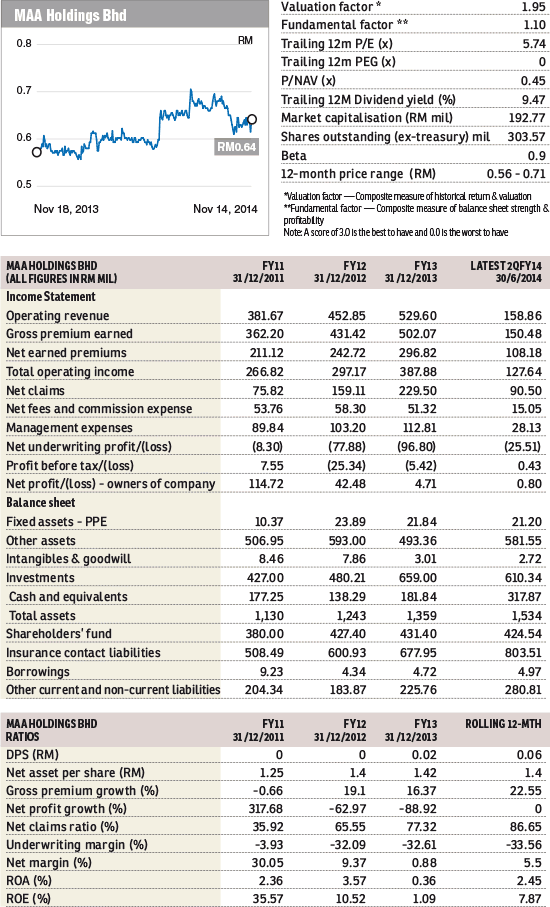

Stocks With Likelihood Of Corporate Exercise: MAA Holdings

The Edge Financial Daily, on November 18, 2014

IOI Corp, SapuraKencana among 7 that could fall off Syariah list, says Maybank IB

http://www.theedgemarkets.com/my/article/ioi-corp-sapurakencana-among-7-could-fall-syariah-list-says-maybank-ib

The Edge 18 Nov 2014

From the present list of 666 Shariah compliant stocks, we focused only on those with a market cap of more than RM300 million (247 stocks) which we felt was a reasonable cut-off point, and filtered the list further based on the cash/asset and debt/asset financial ratios of the individual PLCs.

Maybank IB said it remained wary of potential knee-jerk price weaknesses should these stocks be excluded, given that the Syariah funds would have to liquidate their positions if they are sitting on gains from these investments.

The Edge 18 Nov 2014

From the present list of 666 Shariah compliant stocks, we focused only on those with a market cap of more than RM300 million (247 stocks) which we felt was a reasonable cut-off point, and filtered the list further based on the cash/asset and debt/asset financial ratios of the individual PLCs.

Maybank IB said it remained wary of potential knee-jerk price weaknesses should these stocks be excluded, given that the Syariah funds would have to liquidate their positions if they are sitting on gains from these investments.

Tuesday, 11 November 2014

Malaysia's Cagamas adds amortisation to bond, sukuk programme

http://www.theedgemarkets.com/en/article/malaysias-cagamas-adds-amortisation-bond-sukuk-programme

The Edge 10 Nov 2014

Cagamas's mandate as the national mortgage corporation and the leading issuer of AAA debt securities in Malaysia is to facilitate home ownership but, is also exploring ways to develop a deeper and more liquid domestic bond market.

Definition: An amortising bond is structured in a way that gradually reduces the value of the bond over a fixed period of time, meaning the borrower pays off the full amount before the final maturity date.

Amortising bonds are commonplace, but the format is rare for sukuk. Last year, Dubai's Emirates airline launched the first such sukuk in the international market, a 10-year $1 billion deal with an average weighted life of five years.

This would not affect the programme's AAA credit rating from RAM Rating Services, the company added.

The Edge 10 Nov 2014

Cagamas's mandate as the national mortgage corporation and the leading issuer of AAA debt securities in Malaysia is to facilitate home ownership but, is also exploring ways to develop a deeper and more liquid domestic bond market.

Definition: An amortising bond is structured in a way that gradually reduces the value of the bond over a fixed period of time, meaning the borrower pays off the full amount before the final maturity date.

Amortising bonds are commonplace, but the format is rare for sukuk. Last year, Dubai's Emirates airline launched the first such sukuk in the international market, a 10-year $1 billion deal with an average weighted life of five years.

This would not affect the programme's AAA credit rating from RAM Rating Services, the company added.

Unrated Bonds

http://www.thestar.com.my/Business/Business-News/2014/11/12/Rate-hike-pause-likely-on-falling-commodities-This-will-make-it-easier-for-countries-to-juggle-their/?style=biz

The Star Online 12 Nov 2014

1) Falling commodity prices will confer spillover benefits on taming inflationary pressures around the world, and this will pause possible rate hikes.

2) Many investors today are willing to take up unrated papers because they can actually get better yields if it doesn’t go into the market. Moving forward, unrated papers will pose a challenge to us. One is from the issuer itself. From their point of view, if they are already well-recognised, they would think there may be no need to rate their papers since they are well-recognised in the market. With a rating, the issuer would be subject to the (lower) yields in the market.

http://www.theedgemarkets.com/en/node/169136

- can be traded to create liquidity in the financial market.

- unrated papers are allowed in the market as long as they are not transferred and traded.

- account for about 30% of the total local bond issuance

The Star Online 12 Nov 2014

1) Falling commodity prices will confer spillover benefits on taming inflationary pressures around the world, and this will pause possible rate hikes.

"Commodity

prices are the wild card here. Lower commodity prices reduce

inflationary pressures and justify delaying monetary policy tightening.

This helps keep policy rates lower for a bit longer, as inflationary

pressures are not there to warrant a quicker increase."

2) Many investors today are willing to take up unrated papers because they can actually get better yields if it doesn’t go into the market. Moving forward, unrated papers will pose a challenge to us. One is from the issuer itself. From their point of view, if they are already well-recognised, they would think there may be no need to rate their papers since they are well-recognised in the market. With a rating, the issuer would be subject to the (lower) yields in the market.

RAM: Unrated bonds to erode market share, rating agencies' market position

Unrated bonds, or debt instruments that have not been assessed by a

credit rating agency, will erode the share of the market for rated bonds

as well as the credit rating agencies' market position.

"If the [unrated bonds] market becomes too big, RAM Rating Services Bhd might lose the

ability to track a company's paper credit risks." Come 2015, unrated papers in the market - can be traded to create liquidity in the financial market.

- unrated papers are allowed in the market as long as they are not transferred and traded.

- account for about 30% of the total local bond issuance

Tuesday, 4 November 2014

Capitalism Through The Ages

The Economist | Capitalism through the ages: A grand tour http://www.economist.com/news/books-and-arts/21629211-experts-look-back-economic-system-dominates-western-world-grand-tour?frsc=dg%7Cd via @theeconomist

Accrual Accounting

http://www.thestar.com.my/Business/Business-News/2014/11/04/Transparent-system-Accrual-accounting-will-better-enable-Govt-to-manage-its-finances/?style=biz

Malaysia decides to switch to accrual accounting from the current cash-based accounting system in the public sector.

Accrual accounting takes into account more than just cash flows, but all the Government’s assets and liabilities, including off-balance items as well as pension obligations for public servant.

The real issue about how strong a Government’s balance sheet is not determined by the level of its debt to gross domestic product, or GDP, but the actual net worth of the Government Net worth was a better gauge of the Government’s fiscal position as it took into account all the assets that the state had against its total liabilities.

Malaysia decides to switch to accrual accounting from the current cash-based accounting system in the public sector.

Accrual accounting takes into account more than just cash flows, but all the Government’s assets and liabilities, including off-balance items as well as pension obligations for public servant.

The real issue about how strong a Government’s balance sheet is not determined by the level of its debt to gross domestic product, or GDP, but the actual net worth of the Government Net worth was a better gauge of the Government’s fiscal position as it took into account all the assets that the state had against its total liabilities.

JPMorgan under US criminal probe on forex trade

http://www.thestar.com.my/Business/Business-News/2014/11/04/JPMorgan-under-US-criminal-probe-on-forex-trade/?style=biz

The foreign exchange probe follows a stream of regulatory fines and investigations on JPMorgan on mortgage-backed securities, its handling of the accounts of convicted fraudster Bernard Madoff and its hiring of relatives to powerful Chinese government officials, among other issues.

The foreign exchange probe follows a stream of regulatory fines and investigations on JPMorgan on mortgage-backed securities, its handling of the accounts of convicted fraudster Bernard Madoff and its hiring of relatives to powerful Chinese government officials, among other issues.

Subscribe to:

Posts (Atom)