Tuesday, 28 October 2014

Islam and the ‘corporate mystics’

http://www.thestar.com.my/Opinion/Columnists/IKIM-Views/Profile/Articles/2014/10/21/Islam-and-the-corporate-mystics/

Sunday, 26 October 2014

Malaysia and Singapore: Milking It

The Economist | Malaysia and Singapore: Milking it http://www.economist.com/news/asia/21627707-old-enmities-plague-crucial-partnership-milking-it?frsc=dg%7Cd via @theeconomist

Thursday, 16 October 2014

MAS Privatisation and PN17

Nov 6 D-Day for Malaysia Airlines after Govt investment of RM17.4bil

http://www.thestar.com.my/Business/Business-News/2014/10/16/D-Day-for-Malaysia-Airlines/?style=bizWhat is a PN17 company? Do you sell or buy its shares.

http://www.thestar.com.my/Story/?file=%2F2010%2F7%2F14%2Fbusiness%2F6659149&Thursday, 9 October 2014

Latest on the Mega Merger

CIMB and RHBCap shares are valued at RM7.27 and RM10.03 respectively, in merger deal.

CIMB valued at 1.7 times price-to-book and RHBCap at 1.44 times in merger deal.

CIMB Islamic, RHB Islamic and MBSB will merge to form a mega-Islamic Bank, at RM2.82 per MBSB share.

CIMB shareholders will own 70% of the merged CIMB-RHB Group and RHBCap shareholders the remaining 30%.

Bursa likely to reject exemption for EPF to vote on banks merger

http://www.theedgemarkets.com/my/article/bursa-likely-reject-exemption-epf-vote-banks-mergerBank merger plan can still proceed even if EPF is not allowed to vote

http://www.theedgemarkets.com/my/article/bank-merger-plan-can-still-proceed-even-if-epf-not-allowed-vote"Sources say the minority shareholders of RHB Capital have to decide what to do, because if the merger does not proceed, the stock could come under selling pressure.

The merger proposal values RHB Capital at RM10.03 a share, although there is no cash involved as the transaction is a share swap between RHB Capital and CIMB Group.

If Bursa does not allow EPF to vote, the chances of it (merger) failing is higher and this may result in CIMB’s stock going up as the market has perceived this deal to be negative for them. Alternatively, RHB and MBSB may see their stock price coming off."

Wednesday, 8 October 2014

Running Banks Like Casinos

The Economist | The future of banking: You’re boring. Get used to it http://www.economist.com/news/leaders/21620201-big-banks-have-changed-lot-there-more-restructuring-come-youre-boring-get-used?frsc=dg%7Cd via @theeconomist

Is flipping a flop?

https://ringgitplus.com/en/blog/Personal-Finance-News/Real-Property-Gains-Tax-in-Malaysia-What-Who-Where-and-How-Much.html

https://www.imoney.my/articles/will-property-flipping-in-malaysia-flop

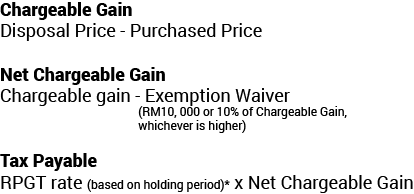

RPGT Calculation Example

Diana (Malaysian citizen), purchased a house in 2012 for RM415,000. She sold it in 2014 for RM560,000. Let's assume that Diana spent RM30,000 in legal fees, agent fees, administrative fees, and maintenance works;

Chargeable gains = RM560,000 – RM415,000 = RM 145,000

Net chargeable gain to be taxed

= (RM145,000 – RM30,000) - 10% individual exemption

= RM115,000 - RM11,500

= RM103,500

Diana sold the property within two years of purchasing it, so the tax imposed on RPGT is 30%.

Tax payable = 30% x RM103,500 = RM31,050.00

https://www.imoney.my/articles/will-property-flipping-in-malaysia-flop

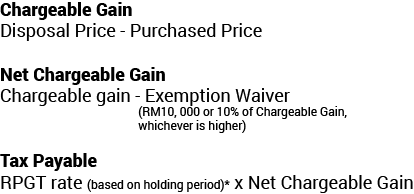

RPGT Calculation Example

Diana (Malaysian citizen), purchased a house in 2012 for RM415,000. She sold it in 2014 for RM560,000. Let's assume that Diana spent RM30,000 in legal fees, agent fees, administrative fees, and maintenance works;

Chargeable gains = RM560,000 – RM415,000 = RM 145,000

Net chargeable gain to be taxed

= (RM145,000 – RM30,000) - 10% individual exemption

= RM115,000 - RM11,500

= RM103,500

Diana sold the property within two years of purchasing it, so the tax imposed on RPGT is 30%.

Tax payable = 30% x RM103,500 = RM31,050.00

Subscribe to:

Comments (Atom)